The “No Tax Manifesto”

Everyone who is familiar with the story of the Pied Piper remembers the greedy, ill prepared bureaucrats and uninformed villagers (citizens) who slighted and deceived a mystical musician who had done them a great deed by playing a magical tune on his ̀ute to rid their village of a terrible and rabid rat infestation. This act saved the village and their lives. In response, the bureaucrats and uninformed villagers slighted the piper (he wasn’t paid). In response, the Pied Piper once again played his magical tune. Only this time, all the children of the village began to dance and sing while gleefully following him directly into a mountain where they were never seen or heard of again. So, the moral of the story? Sooner or later the people of the village had to “pay the piper.” And, so it will go if this community blindly accepts a tax increase of any size before we have all the facts about how our tax dollars are currently being spent and managed — or mismanaged.

The “No Tax Manifesto” has been created from comments and criticisms heard from many Fayetteville citizens who do not feel that our City Manager and City Council are looking closely enough for ways to avoid what some people already think is a done deal — an inevitable 4.2- or 3.8-cent tax increase.

The “No Tax Manifesto” has been created from comments and criticisms heard from many Fayetteville citizens who do not feel that our City Manager and City Council are looking closely enough for ways to avoid what some people already think is a done deal — an inevitable 4.2- or 3.8-cent tax increase.

What difference does it make? Well, it makes a lot of difference to many citizens who think the increase is not needed and that there is not enough being done to maximize or conserve our current tax resources. They do not think that prudent decisions are being made on how to spend and allocate our tax dollars. Of course, this is hard work. So the City Council should insist that the City Manager get to work and take on this responsibility to produce an accurate assessment of our community needs and resources. The City Council should investigate all the needs brought forth to them and resist listening and marching to the music of a “Pied Piper” without proper due diligence. Fayetteville citizens ultimately know best. Here are comments and questions heard echoing throughout the community. Once compiled, these comments made the perfect “No Tax Manifesto.” Enjoy!

Residents would appreciate and respect being provided straight and honest answers to all questions referred to City Manager and Council members. i.e.

• What specifically are the reductions taken by city departments?

• What outsourcing opportunities have been identified that could save the City money and reduce the operating budget?

• How many budgeted unfilled positions does the city have open and how long have they been vacant?

• How many budgeted positions have been vacant for more than thirty months? $$$ Value?

• Why have these positions not been eliminated?

• If the positions are unfilled and have not been eliminated, what is the budgeted money being spent on?

• No doubt city residents are willing to fund and sacrifice for the funding of more police officers and staff. That being said, then what is the justification for proposing 4-10 percent salary increases for city management?

• Enlighten the residents about what we are paying our top city management. Residents should know how much of the proposed tax increase is going to increasing the iǹated salaries of the City Manager and City Management. Could this be an example of income inequality?

• Articulate in detail some of the potential savings from merging PWC and city departments.

• Discontinue ambiguous statements like the city “is lean” or “we just can’t cut anymore.” Talk in specifics about these situations

.• Provide specific assurances that all city departments are being managed and operated efficiently. Address areas that are not. Again, specifically.

• Specifically describe efficiencies and budget-saving measures found in all departments.

• Disclose and define what discretionary funding is. How will the City Manager use this money in the future? Why is it discretionary?

• It should be considered that only the loyal, hardworking rank-and-file workers of the City receive a 2.5 percent salary increase. All other city management, including the Mayor and City Council, should forego any salary rate increases.

• Assure Fayetteville residents that the budget proposed is specifically for funding police, reducing crime and providing essential city services to our residents and not for building bureaucracies like economic development or allocating funding to iǹate the salaries of upper management and hire more staff.

• Emphatically, fund the police department first. Then fund everything else.

• New revenue and funding sources. What are they? Who is coming up with innovative ideas?

•Transparency is a must. The taxpayers need to know what part of the tax increase is going to city management salary increases. Also, make sure all City Councilmen knowingly admit that they understand this. This way they cannot claim after the fact they were not aware of the process.

•Share with the residents how big the city staff has grown over the past three years compared to private industry in Fayetteville.

• Get a consensus from the Mayor and City Council: Ask the question, “Should the city government be iǹating itself at a time when the cost will be born largely by Fayetteville’s working middle class, seniors, retirees and our low income families — all of which cannot afford it?”

In conclusion, time is not on the citizens’ side. This is coming down to the wire and a rush vote with an unfortunate tone of “Oh well, a 3.8-cent increase is better than a 4.2-cent increase.” Then everyone votes for the compromise. No. This is NOT the way it should be done. Everyone must be held accountable. At this point, there are way too many unanswered questions and uninformed city councilmen who are not leading but being led. It is here that courage and backbone are essential. Step one: Get the facts. Step two: Stand up, take a position and be prepared to defend it with specifics. Not generalizations. This is real leadership. Within the week, we’ll see who has it.

Thanks for reading Up & Coming Weekly.

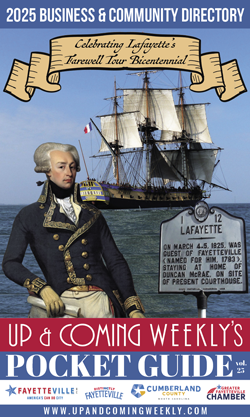

Photo: Before raising taxes, find out what the Fayetteville residents have to say.

How to resolve AdBlock issue?

How to resolve AdBlock issue?